Investment Solutions

IPC ESSENTIALS GROWTH PORTFOLIO

| MINIMUM INVESTMENT | MINIMUM SUBSEQUENT INVESTMENT |

|---|---|

| $500 | $50 |

The Portfolio is designed to provide long-term capital appreciation. The Portfolio’s target asset mix is 80% equity securities and 20% fixed-income securities.

KEY REASONS TO INVEST IN THIS PORTFOLIO

- Utilizes a variety of ETFs to provide exposure to key markets

- Structured to be a lower-cost solution

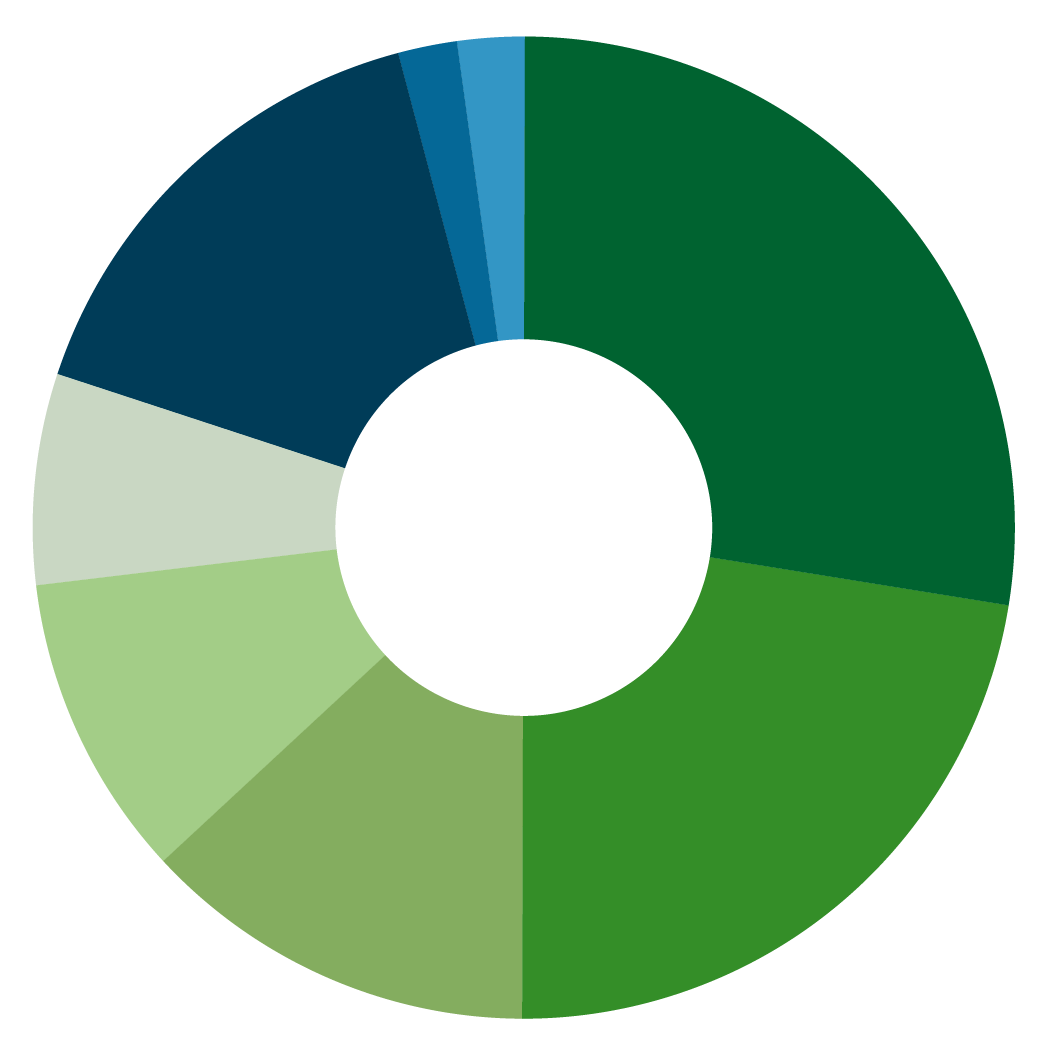

80% Equity (Can range between 70 - 90%)

20% Fixed Income (Can range between 10 - 30%)

| Top Holdings | |

|---|---|

| Mackenzie US Large Cap Equity Index ETF | 29.85% |

| Mackenzie International Equity Index ETF | 17.00% |

| Mackenzie Canadian Equity Index ETF | 14.00% |

| Mackenzie Canadian Aggregate Bond Index ETF | 13.50% |

| Mackenzie Developed Markets Real Estate ETF | 6.80% |

| IShares MSCI EAFE Small-Cap ETF | 4.25% |

| iShares Core S&P Small-Cap ETF | 4.25% |

| iShares Broad USD High Yield Corporate Bond ETF | 3.65% |

| Mackenzie Emerging Markets Equity Index ETF | 3.25% |

| iShares J.P. Morgan EM Corporate Bond ETF | 1.95% |

| Mackenzie Canadian Short-Term Bond Index ETF | 1.50% |

Popular Documents

Key Data

RISK

Low - Medium

DISTRIBUTIONS

Monthly

FEES (%)

| Series | Mgmt. | Admin. | MER. |

|---|---|---|---|

| A | 1.35 | 0.15 | 1.77 |

| F | 0.35 | 0.15 | 0.65 |

| I | 0.35 | 0.15 | 0.21 |

MER reflected is for September 30, 2022 and includes GST/HST

*Effective June 15, 2022, the management fee and/or the administration fee were lowered, which will result in a lower MER.

ASSET CLASS

Global Equity Balanced

INCEPTION DATE

September 13, 2018

RRSP ELIGIBLE

Yes